What You Need to Know Before Buying Life Insurance on Your Spouse

Life insurance for your spouse is a necessity, but the type and amount of insurance you purchase is just as important. Before you buy life insurance on your spouse, you need to consider several important factors.

The Type of Insurance

The type of insurance you purchase will determine your monthly rates, the benefit amount, and the longevity of the policy. These are very important considerations in spousal life insurance.

At GAL Insurance Center, you can choose between term and whole life insurance, the two main types offered by top-rated insurance companies. Term life insurance remains in effect for a specific period of time, such as 10, 20, or 30 years, although the policy can be for as little as one year. If your spouse should die during the time period that the policy is in effect, the beneficiary of the policy will receive the proceeds of the policy.

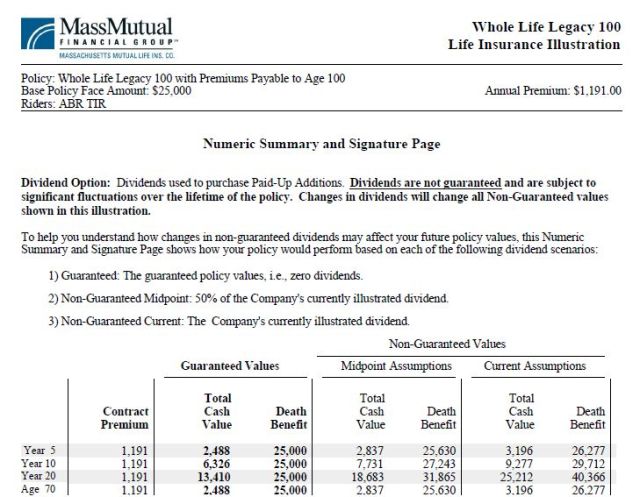

On the other hand, whole life insurance has no determinate time period. It remains in effect for the life of the policy holder, as long as the monthly premiums are paid. In most cases, whole life insurance builds up equity over time, providing the policy holder with funds he or she can borrow for emergencies or major expenditures. The equity can also sometimes be used as collateral when applying for a loan.

The Cost

Term life policies are generally less expensive than whole life—mainly because they are for a set period of time and have an expiration date. Whole life insurance is usually more expensive than term life, because it does build equity and remains in effect during the life of the policy holder (increasing the likelihood that the insurance company will pay a death benefit to the beneficiary).

How Much Coverage is Necessary

The amount of coverage for life insurance for your spouse will depend on your financial situation, as well as the number of children or dependents you have. It is recommended that you list your assets, such as bank accounts, real estate, furnishings, retirement and/or other benefits, and your debts, including mortgages, loans, and college tuition. How much money will you need to support yourself and your children? How much money will be necessary for your spouse’s debts and funeral expenses? How long will you need additional support until your children are grown, mortgage is paid, etc.?

Remember that life insurance is not for the deceased—it’s for their family and/or loved ones. Its purpose is to provide the necessary funds to replace loss of income. This includes stay-at-home parents—while they don’t bring home a paycheck for their contribution to the family, the surviving spouse may have to hire additional help to perform their duties with the house and children. When contemplating coverage, calculate an estimate of those costs over time.

How to Purchase Life Insurance for Your Spouse

As a spouse, it’s likely that you have an insurable interest in your husband or wife’s life, meaning you will be financially impacted if he or she dies. Therefore, you can purchase life insurance on them, but only if they grant permission for you to do so. However, if your spouse is not employed and you cannot prove his or her death will affect you financially, you may not be able to claim insurable interest. A licensed life insurance agent can help you determine your eligibility and the type and amount of life insurance that’s best suited for you and your family.

GAL Insurance Center is experienced in helping married couples obtain affordable life insurance that meets their needs. At GAL Insurance Center, we offer affordable guaranteed life insurance, term or whole Life. That means your premium is guaranteed, your death benefit is guaranteed, and for whole life plans, your cash values are guaranteed. We believe life insurance should start out to be what you can afford to keep. GAL Insurance Center is designed to allow for direct purchasing of life insurance without an agent, as well, to allow you to purchase online or by phone after receiving a free quote from over 50 top rated insurance carries bidding for your business. We believe the best life insurance is one that is guaranteed and pays off when you or your family needs it. Our monthly rates start as low as $3.75 month and policy amounts start as low as $2,500 online or by phone. Go to GALInsuranceCenter.com and take control of your life insurance needs.